Connect with a Sage Fixed Assets (Sage FAS) specialist for support, demo, training

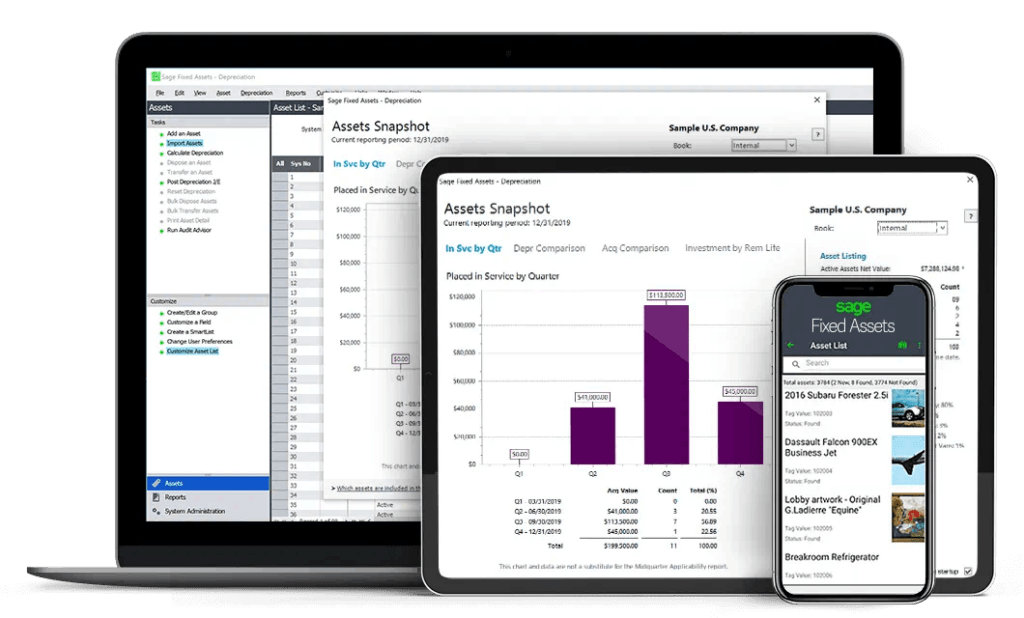

Sage Fixed Assets is a desktop-based software designed for businesses to manage their fixed assets, such as buildings, machinery, and equipment. It helps businesses keep track of their fixed assets, calculate depreciation, and stay compliant with accounting regulations.

Sage Implementation

Implement your solution in accordance with proven strategies for achieving success. We can help you save time and improve accuracy by tailoring the software to your needs.

Sage Partner

As a Sage partner, we provide a comprehensive suite of Sage products under one roof. Our team specializes in delivering end-to-end Sage solutions tailored to our client’s unique needs.

Sage Experts

We offer reliable Sage assistance to our users. Our team of experts is dedicated to providing timely and effective support, ensuring that your Sage experience is as seamless as possible. Call Now

Sage Fixed Assets Features

Talk to the Experts

Get your issue resolved quickly with access to first-class professionals that know how to help.

Experience the power of Sage Fixed Assets with a free trial run!

- Try it free - no strings attached! No fees, no commitment, and no credit card needed."

- Take advantage of a 30-day free trial and explore the software's features. The test drive includes a detailed walkthrough guide highlighting key features and their usage

- You don't need to install anything as the test drive is a cloud-based version of Sage 50, and it includes sample data to enhance your experience.

FAQs

To get the maximum benefit of your fixed assets, look for fixed asset software that offers:

- Full lifecycle management – acquisition, depreciation, transfers, disposals, construction in progress (CIP), and tracking, including barcode tracking.

- The latest and most accurate tax and GAAP rules and calculations.

- Robust financial reporting, including general ledger posting, depreciation expense, and roll-forward reports for reconciliations.

- Accurate tax reporting with annually updated IRS Forms 4562, 4797, and others.

- Flexible deployment options and integration links with other software to continue to do business your way–whether that’s on-premises or in the cloud.